Introduction

Credit utilization is one of the most frequently referenced—but often misunderstood—components of credit scoring in the United States. While many consumers associate credit scores primarily with payment history, public data and scoring model disclosures consistently show that how much credit is used relative to available limits plays a significant role in how credit profiles are evaluated.

According to consumer education materials from the Consumer Financial Protection Bureau (CFPB) and public explanations provided by FICO, credit utilization is generally considered one of the most influential factors after payment history in commonly used scoring models. However, utilization is not a fixed rule or threshold; rather, it is a dynamic ratio that can change from month to month based on reported balances and credit limits.

This article provides a neutral, educational, U.S.-specific explanation of how credit utilization works, how it is calculated, what public data shows about typical utilization patterns, and why it matters within the broader credit reporting and scoring framework. It does not offer advice, strategies, inducements, or recommendations.

What Is Credit Utilization?

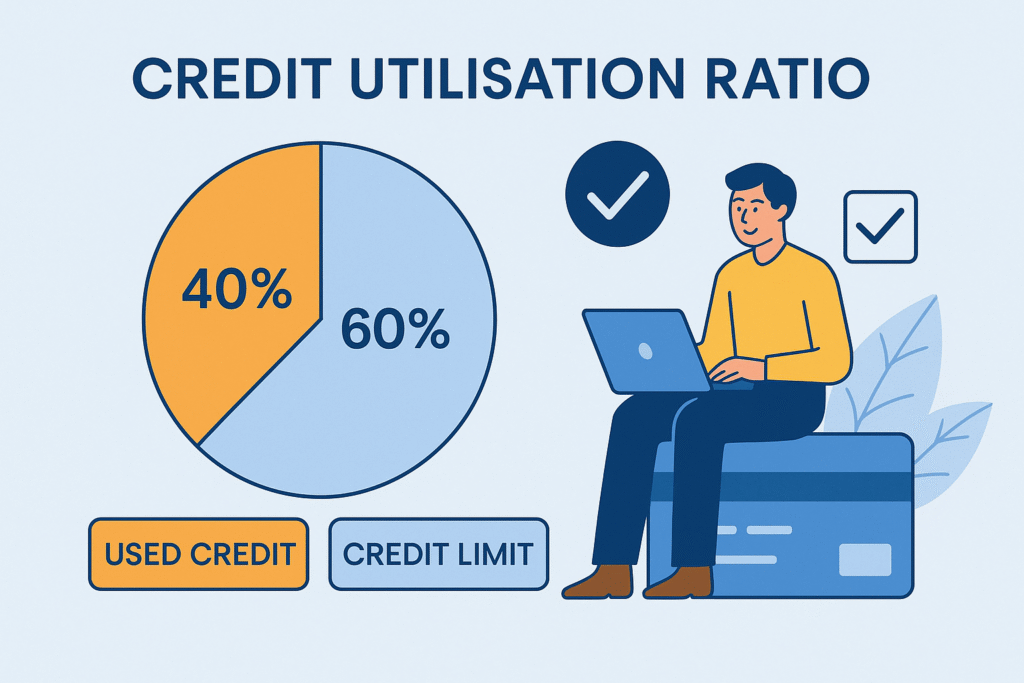

In U.S. consumer credit reporting, credit utilization refers to the proportion of available revolving credit that is currently being used.

It is most commonly discussed in relation to:

- Credit cards

- Lines of credit

Installment loans (such as mortgages, auto loans, or student loans) are not typically evaluated using utilization ratios in the same way.

Basic Concept (Illustrative Only)

If a consumer has:

- A total credit card limit of $10,000

- A total reported balance of $3,000

The utilization ratio would be 30%.

This example is illustrative, not prescriptive.

Revolving Credit vs. Installment Credit

Understanding credit utilization requires distinguishing between two major credit types:

Revolving Credit

- Credit cards

- Retail charge cards

- Personal lines of credit

Balances fluctuate monthly, and utilization ratios apply directly.

Installment Credit

- Mortgages

- Auto loans

- Student loans

These loans have fixed payment schedules and are not evaluated using utilization ratios in the same manner.

This distinction is highlighted in CFPB and FTC consumer education materials to clarify why utilization discussions focus primarily on credit cards.

How Credit Utilization Is Calculated

Aggregate (Overall) Utilization

Aggregate utilization looks at:

- Total revolving balances across all accounts

- Divided by total revolving credit limits

This provides a portfolio-level view of credit usage.

Per-Account Utilization

Utilization can also be evaluated:

- On each individual credit card or line of credit

For example, a consumer may have:

- Low overall utilization

- High utilization on a single card

Public credit education materials note that both aggregate and per-account utilization may be reflected in scoring outcomes, depending on the model used.

Why Credit Utilization Matters in Credit Scoring

Role in Risk Assessment

From a scoring model perspective, utilization serves as:

- A proxy for current credit demand

- A signal of how much available credit is being relied upon

According to FICO’s published explanations:

- Higher utilization ratios are statistically associated with higher default risk

- Lower utilization ratios are associated with lower observed risk

This relationship is correlational, not causal, and is based on large-scale historical credit data.

Weight in Scoring Models

While exact formulas are proprietary, FICO publicly states that:

- Payment history is the most influential factor

- Amounts owed (which includes utilization) is typically the second most influential category

This ranking is widely cited in CFPB and FTC consumer education materials.

What Public Data Shows About Utilization Patterns

National Credit Bureau Data

According to aggregated credit bureau statistics published by Experian:

- Consumers with higher credit scores tend to have lower average utilization

- Consumers with lower scores tend to carry higher revolving balances relative to limits

For example, Experian has reported that:

- Consumers with “prime” or higher scores often maintain utilization well below 30% on average

- Consumers with lower scores often have utilization well above that level

These figures reflect observed trends, not requirements or recommendations.

Utilization and Monthly Reporting Cycles

Statement Balance vs. Payment Timing

Credit card issuers typically report balances:

- Once per billing cycle

- Often based on the statement balance, not the payment due date

As a result:

- A consumer who pays balances in full each month may still show utilization if balances are reported before payment is applied

- Utilization can fluctuate even without long-term debt accumulation

This reporting structure explains why utilization can change month to month.

Credit Limits and Utilization

Role of Credit Limits

Utilization ratios are influenced by:

- Reported balances

- Credit limits assigned by issuers

Two consumers with identical balances can have very different utilization ratios depending on their available limits.

Credit limits are determined by issuers based on internal criteria and are not controlled by the consumer.

Common Misunderstandings About Credit Utilization

“Using Credit Is Bad”

Utilization does not measure whether credit is used, but how much of the available credit is used relative to limits.

“One Card Doesn’t Matter”

High utilization on a single card may still be reflected in credit reports, even if overall utilization is lower.

“Utilization Is Permanent”

Utilization is temporary and reversible. Because it is based on current balances, it can change as new data is reported.

Utilization vs. Payment History

While both are influential:

- Payment history reflects past behavior over time

- Utilization reflects current credit exposure

CFPB materials emphasize that these factors capture different aspects of credit risk.

Utilization and Credit Score Volatility

Because utilization is balance-based:

- Scores may fluctuate month to month

- Temporary balance increases can affect reported utilization

This volatility is one reason consumer education materials caution against interpreting short-term score changes as permanent outcomes.

Utilization in Lending Decisions (High-Level Context)

Lenders may review:

- Credit scores

- Credit reports

- Utilization ratios

- Other underwriting factors

However:

- No single utilization level guarantees approval or denial

- Policies vary by lender, loan type, and regulatory environment

This article does not discuss approval criteria.

Regulatory and Consumer Protection Framework

Credit utilization operates within:

- The Fair Credit Reporting Act (FCRA)

- Oversight by the CFPB and FTC

Consumers have rights to:

- Access credit reports

- Dispute inaccurate information

- Receive disclosures about credit decisions

Credit Utilization and Fair Lending Considerations

Credit scoring models are subject to:

- Fair lending laws such as the Equal Credit Opportunity Act (ECOA)

- Oversight to prevent discriminatory practices

Utilization ratios are applied uniformly as mathematical inputs, not demographic characteristics.

Summary: A Data-Based Understanding of Credit Utilization

From a U.S. consumer credit perspective:

- Credit utilization measures how much revolving credit is used relative to limits

- It is one of the most influential components of commonly used credit scores

- Utilization is dynamic and can change monthly

- Both aggregate and per-account utilization may be reflected

- Utilization operates within a regulated credit reporting framework

Understanding utilization helps explain why credit scores can change and how current balances influence reported risk, without implying advice or recommendations.

Author Information

Written by:

Beenish Rida Habib — Mortgage & Lending Contributor, ACT Global Media

Beenish Rida Habib is a Florida-licensed Mortgage Loan Originator with licensing since 2018. She contributes educational content explaining U.S. credit and mortgage concepts.

Editorial Disclosure

This article is provided for general informational purposes only and does not constitute credit, mortgage, financial, or legal advice.

Regulatory Notice

Credit scoring practices vary by model, lender, and regulatory requirements. Information is based on publicly available U.S. sources