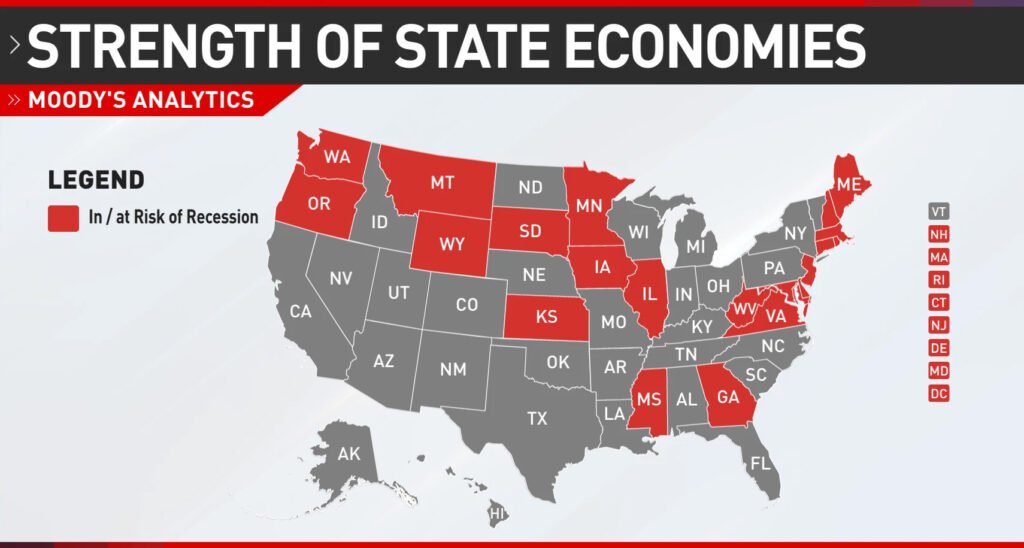

Nearly half of U.S. states are either already experiencing recession-like economic contraction or are very close to it, according to a new analysis by Moody’s Analytics, one of the country’s leading economic research firms.

WEBDESK | ACT GLOBAL MEDIA | JANUARY 19, 2026

The state-level study, compiled by Moody’s chief economist Mark Zandi, shows that while the U.S. economy overall hasn’t officially fallen into recession, significant weaknesses are emerging across large parts of the country.

Key Findings

- 22 states and the District of Columbia are assessed to be either in a recession or at high risk of entering one.

- These states collectively represent about one-third of total U.S. economic output, meaning their struggles could weigh on national performance.

- Another portion of states — roughly 13 — are “treading water” with little growth, while about 16 are continuing to expand economically.

What This Means

A state is considered to be in recession when key economic indicators such as employment levels, personal income, retail sales, manufacturing output, and business activity decline simultaneously. Zandi used a mix of these metrics, similar to the methodology used by the National Bureau of Economic Research (NBER) for national recession dating but applied at the state level.

According to Moody’s, states facing weakness include Wyoming, Montana, Minnesota, Mississippi, Kansas, Massachusetts, Washington, Georgia, New Hampshire, Maryland, Rhode Island, Illinois, Delaware, Virginia, Oregon, Connecticut, South Dakota, New Jersey, Maine, Iowa, West Virginia and the District of Columbia.

Regional Patterns and Risks

Zandi noted that the economic contraction isn’t confined to one region — it’s spread across the country, affecting states in the Midwest, Northeast, South and West.

Some traditionally stronger economies — such as California and New York — are not yet in recession but are only treading water, meaning their growth is flat and fragile. Economists warn that if either of these large state economies were to weaken significantly, it could tip the entire U.S. economy into a full recession.

Behind the Numbers

Moody’s analysts point to several factors contributing to the uneven state-level performance, including:

- Weakness in manufacturing and agricultural sectors in certain regions.

- Federal policy implications, such as tariff impacts and shifts in spending patterns.

- Job market and income pressure among lower- and middle-income households in recession-affected states.

Despite strong national totals — such as overall GDP growth and relatively steady unemployment rates — residents in recession-affected states may already be feeling economic strain through slower job hiring, reduced consumer spending and weaker business activity.